🚢🔥 GLOBAL OIL MARKET ANALYSIS: SUPPLY SURPLUS, PRICE VOLATILITY – WHAT LIES AHEAD FOR THE MARITIME AND ENERGY SECTORS? 🔥🚢

The global oil market is navigating a complex phase, where the supply-demand balance is increasingly tilting towards a surplus. As the lifeblood of the global economy and the maritime industry, what do these fluctuations signify for the energy supply chain and seaborne trade? Join our experts for a deeper analysis!

- Global Oil Demand: Slowing Growth 📉

Global oil demand is projected to grow modestly by 680 thousand barrels per day (kb/d) in 2025 and 700 kb/d in 2026, reaching 104.4 million barrels per day (mb/d). Notably, this forecast has been consistently downgraded by 350 kb/d for 2025 since the beginning of the year, reflecting a more subdued demand outlook than initially anticipated.

- Challenges: Weak demand in major economies such as China, India, Brazil, and OECD countries (especially Japan) is hindering recovery, exerting pressure on energy consumption segments.

- Aviation Bright Spot: The aviation sector stands as an exception, with robust summer travel driving jet/kerosene fuel demand to all-time highs in both the US and Europe. However, at 7.7 mb/d in 2025, this demand remains 180 kb/d below pre-Covid-19 levels from 2019.

- Oil Supply: Strong Growth Momentum 📈

While demand stagnates, supply is accelerating, reshaping the global oil market landscape:

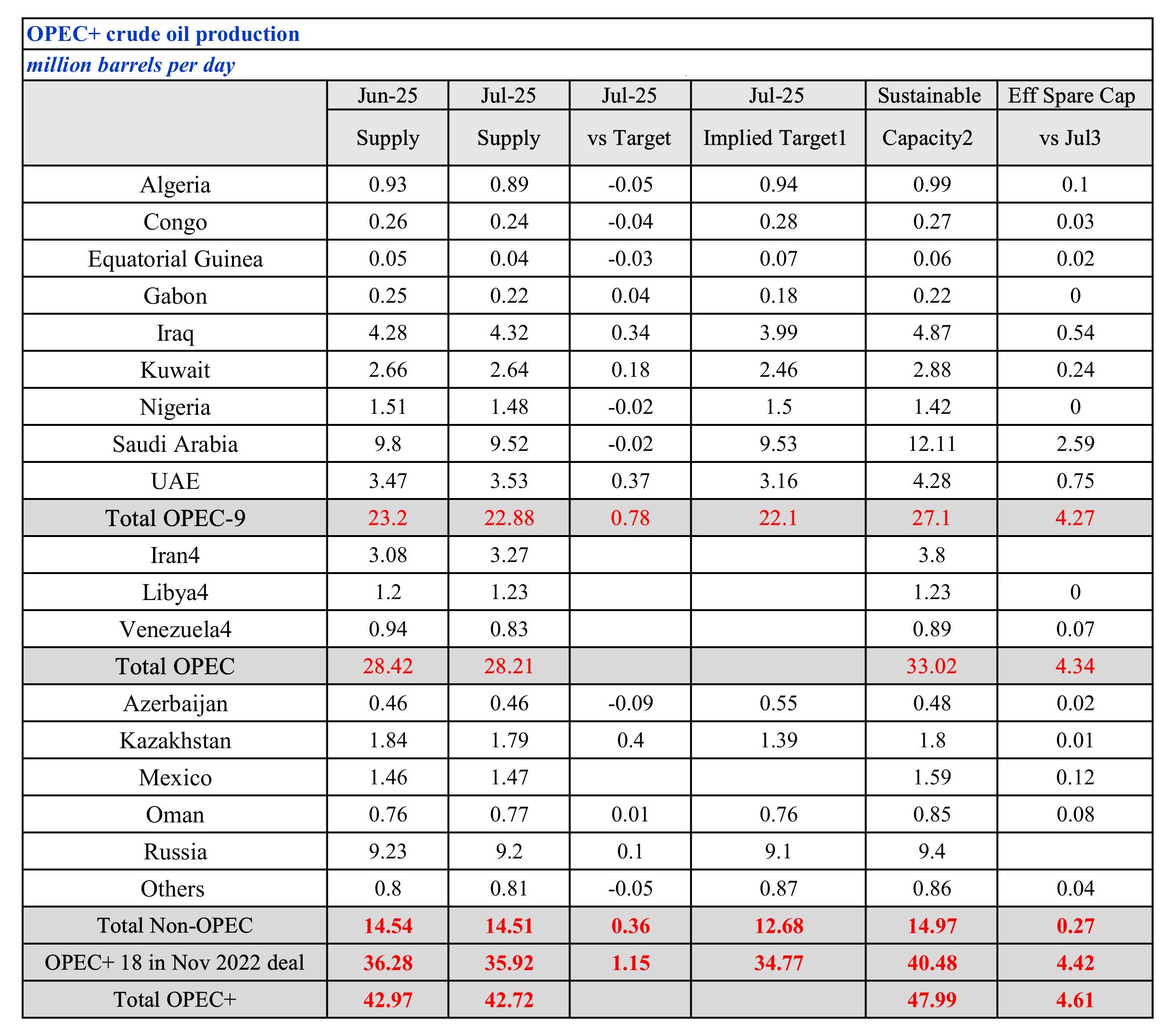

- OPEC+ Easing Cuts: The Organization of the Petroleum Exporting Countries and its allies (OPEC+) have decided to fully unwind their voluntary output cuts of 2.2 mb/d by September. This move will significantly add crude oil to the market, directly impacting the available supply for seaborne transportation.

- Non-OPEC+ Production Rises: Non-OPEC+ producers such as the US (Natural Gas Liquids – NGLs), Canada (crude oil), Brazil, and Guyana (offshore oil) continue to lead supply growth, adding 1.3 mb/d in 2025 and 1.1 mb/d in 2026.

- Overall Growth Forecast: Total global oil supply is adjusted upwards to 2.5 mb/d in 2025 and 1.9 mb/d in 2026, creating a clear outlook for a supply surplus.

- Inventories and Refining Activity: Market Absorption Capacity 📦🚢

The supply-demand imbalance has led to global oil inventories rising for the fifth consecutive month in June, reaching a 46-month high of 7,836 million barrels.

- Oil on Water and Strategic Stocks: This increase is primarily supported by swelling volumes of oil on water, alongside rising stocks of Chinese crude and US gas liquids. China is acting as a crucial “buffer,” absorbing the excess oil in the market.

- Refining Operations: Global crude runs are also operating at full capacity, with throughputs projected to reach an all-time high of 85.6 mb/d in August. Robust refining margins have fueled this activity.

- Crude Oil Price Volatility: Downward Pressure 📉

Benchmark crude oil prices (Brent) fell from approximately $70/barrel to $67/barrel in early August.

- Market Reaction: This decline occurred immediately after OPEC+ announced its plans to increase production, indicating the market’s sensitive reaction to the prospect of a supply surplus.

- Unsustainable Stock Builds: The outlook for continued “unsustainable stock builds” is also exerting downward pressure on prices, signaling a market gradually reaching saturation in terms of storage capacity.

- Geopolitics: Opposing Forces Shaping Trade Flows 🌍⚖️

Geopolitical factors remain a significant variable, creating opposing forces and dynamics in the oil market and maritime trade flows:

- Sanctions: The US and EU continue to impose new sanctions on Russia and Iran, aiming to restrict their oil sales, which could impact shipping routes and supply from major producers.

- Easing Restrictions: Conversely, restrictions on Venezuela have been eased, allowing Chevron to operate and export oil again, potentially adding supply to the market.

These conflicting policies create uncertainty regarding the future direction of supply and seaborne trade lanes.

The global oil market is facing a significant balancing challenge. With supply likely to outpace demand in the near future, the prospect of a market surplus is evident. Complex geopolitical factors further amplify unpredictability, requiring market participants, especially within the maritime and energy sectors, to closely monitor developments and adjust strategies to navigate an environment prone to oversupply and price volatility.

What are your thoughts on these developments and their impact on the maritime industry? Share your expert insights in the comments below! 👇

– https://www.hellenicshippingnews.com/oil-market-imbalance-set-to-increase-as-rising-supply-outpaces-demand-growth/