🚨 BREAKING NEWS: HOW THE TANKER SHIPPING MARKET WILL DIVERGE IN 2025-2026 👇

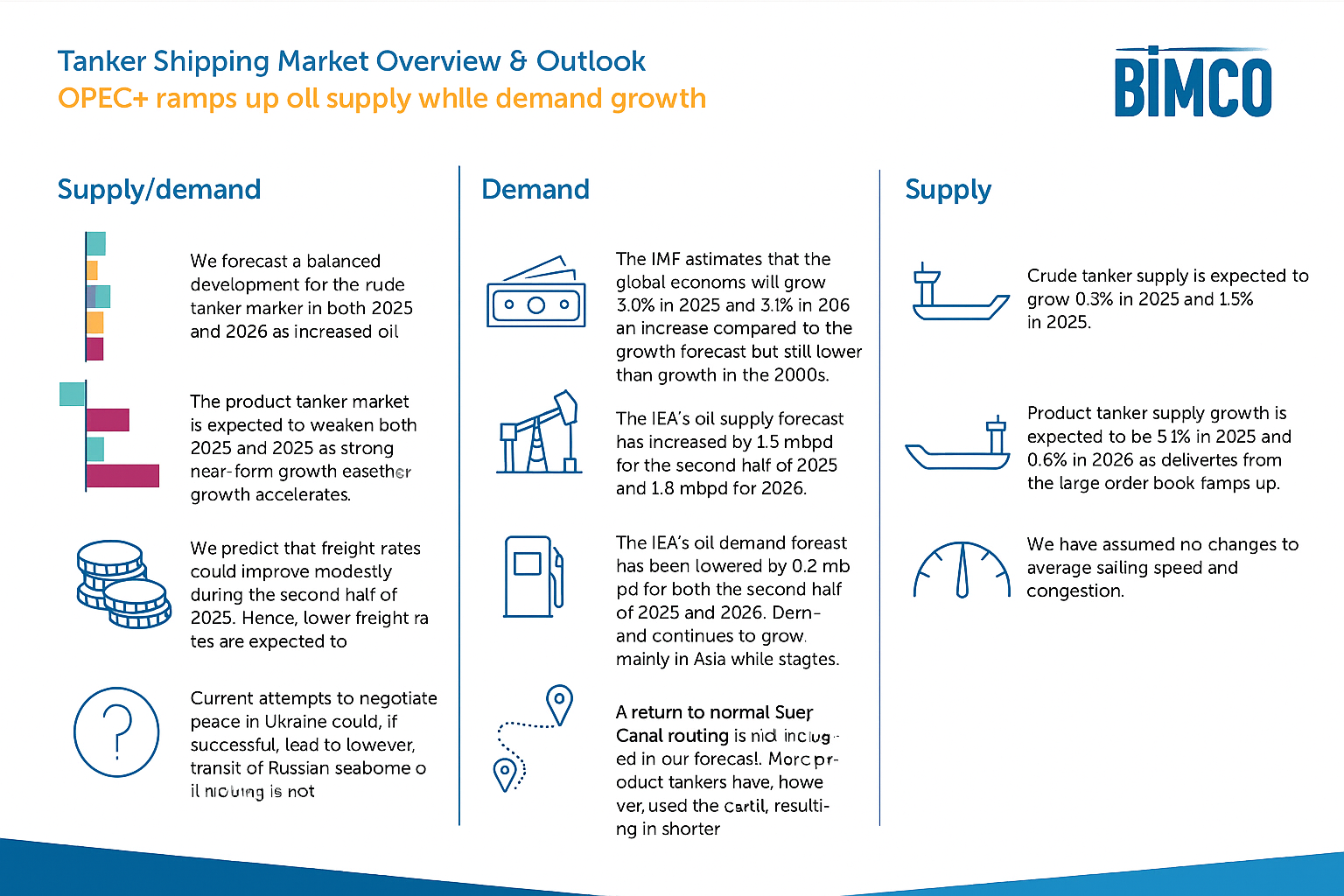

According to a new BIMCO report, the tanker shipping market faces an intriguing paradox: despite a significant global oil surplus, the fates of crude tankers and product tankers are set to diverge dramatically.

Here are the 5 key takeaways you need to know:

📈 1. OPEC+ Ramps Up Production, Creating a Massive Oil Surplus

- The IEA forecasts a global oil surplus of 2.3 million barrels per day (mbpd) in late 2025, rising to 3.0 mbpd in 2026.

- This surplus is projected to peak at an impressive 4.1 mbpd in Q1 2026!

📉 2. Falling Oil Prices… A Good Thing?

- The EIA projects average Brent crude prices could drop to $51/barrel in 2026.

- This lower price environment can incentivize traders to hold oil in floating storage, primarily using larger crude tankers, creating unexpected demand for this segment.

⚓ 3. Crude Tankers: A “Balanced” Market

- Thanks to potential storage demand and modest fleet supply growth (0.5% in 2025 and 1.5% in 2026), this segment is forecasted for a “balanced development.”

⚠️ 4. Product Tankers: A Weaker Outlook

- This segment faces a double headwind:

- Significant Fleet Growth: Supply is set to surge by 3.5% in 2025 and 6.5% in 2026, driven by new vessel deliveries.

- Decreased Tonne-Mile Demand: As new refineries come online in former importing nations, average sailing distances are shortening, limiting demand.

🕊️ 5. The “Peace” Paradox?

- A return to normal Red Sea routes or a peace agreement in Ukraine could shorten sailing distances, reducing crucial tonne-mile demand and putting further pressure on freight rates.

In conclusion: Not all tankers will share the same fate! A nuanced understanding of the distinct dynamics between crude and product tankers is key to navigating the market in the coming years.

What are your thoughts on these challenges and opportunities? 🤔 Let us know in the comments below!

#BIMCO #Maritime #Geopolitics #OilMarket #ShippingIndustry #SupplyChain #Logistics #OPEC